Get signed up for ADM FarmView

Engage with ADM through ADM FarmViewTM, available on mobile and desktop. This has replaced GrainBridge, which will no longer be supported after August 25.

Visit ADMFarmView.com or download today on the App Store or Google Play.

Scroll below for login instructions. If you do not have a login with ADM, contact your local ADM rep.

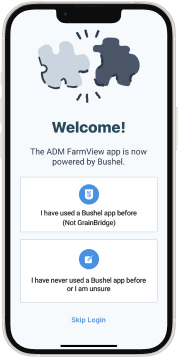

How to Log in to the new ADM FarmView App, or Create a New Account

STEP 1

Install “ADM FarmView” from the App Store or Google Play.

IMPORTANT: Please login or create your account with the same email address as your GrainBridge credentials. You will be required to create a new password.

STEP 2

Select the prompt that applies to you.

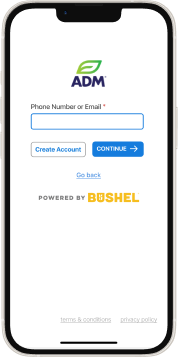

STEP 3

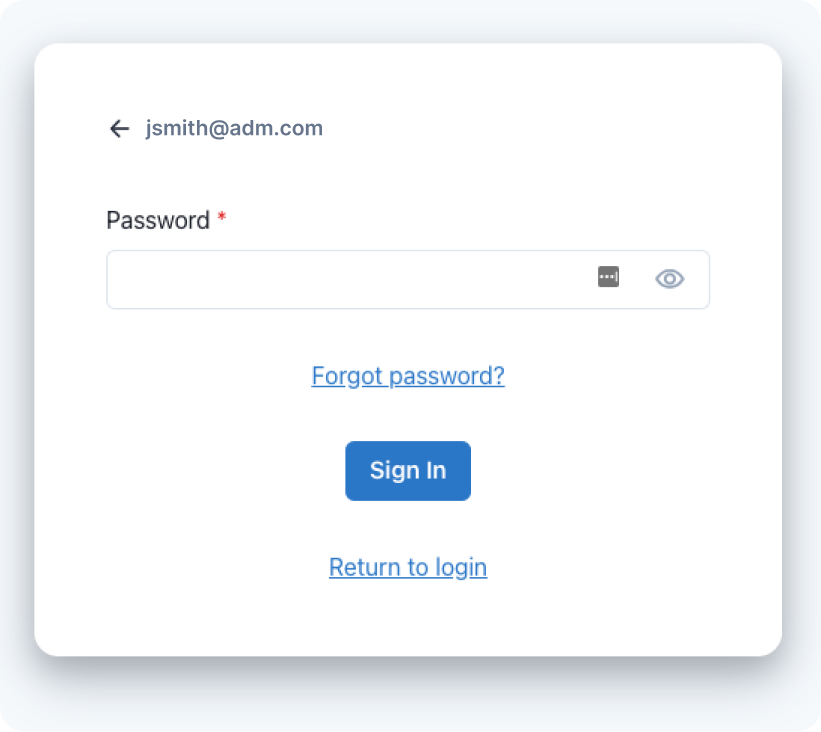

Log in and update existing Bushel account

STEP 3 (CONT.)

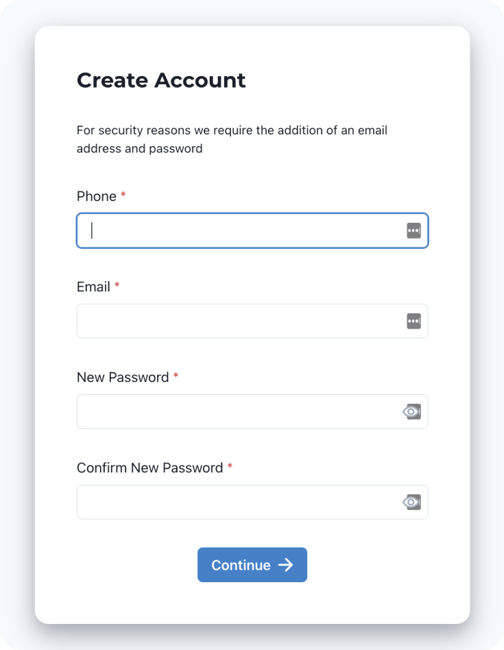

OR Create an account

STEP 4

Verify by entering the code sent to your email.

LOG IN AND DONE!

When logging in with an Apple device, be sure to enable notifications for important information from your elevator.

How to Log in to the new ADM Web Portal, or Create a New Account

STEP 1

Visit ADMFarmView.com and click ‘Sign in’

IMPORTANT: Please login or create your account with the same email address as your GrainBridge credentials. You will be required to create a new password.

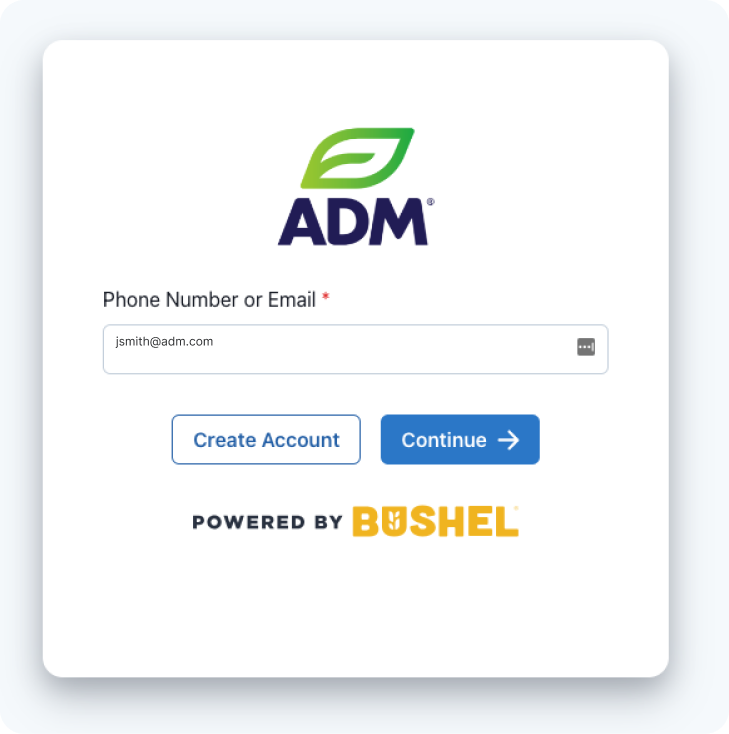

STEP 2

Enter email and click ‘Continue’ to log in

or click 'Create Account'

STEP 3

Verify by entering the code that was sent to your email.

Log in and done!

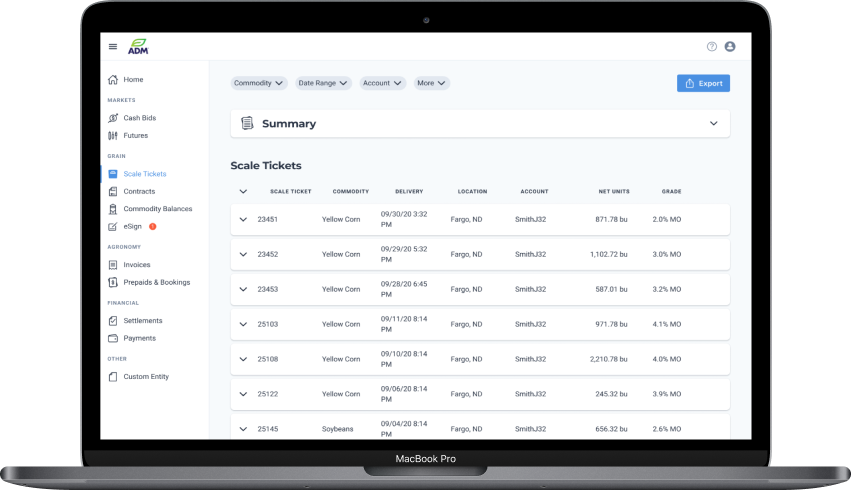

Get More Done with ADM FarmView

-

24/7 access to futures and ADM cash grain bids through desktop and mobile app

-

View grain in storage, application status, and delayed price

-

View your scale tickets in near real-time.

-

See information pertinent to revenue forecasting with settlements

-

Receive updates from local ADM locations through mobile app push notifications

-

Check the status of grain contracts

-

Access daily market reports and commentary

-

Secure account access and free to use

-

View scale tickets applied to contracts and settlements (desktop only)